Concentrations at extremes – valuations near extremes.

This substantially reduces future long-term returns for equities.

Long-term investors need to prepare now!

Concentrations at extremes – valuations near extremes.

This substantially reduces future long-term returns for equities.

Long-term investors need to prepare now!

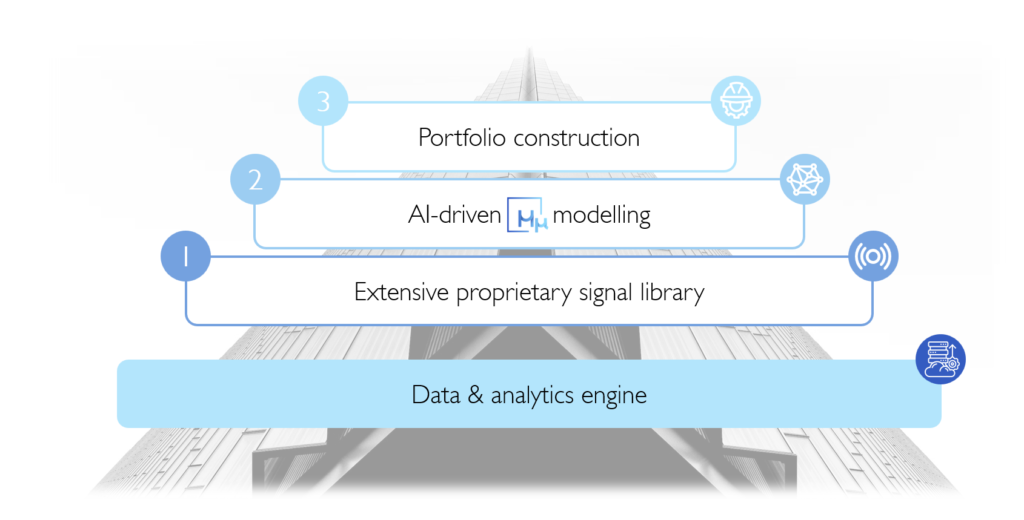

We help you identify attractive opportunities within equities especially in recently neglected market segments with our AI driven stock selection approach.

Exploring novel sources of returns through the application of modern machine learning methods and insights from financial market research.

Exposure to long-term compensated factor premia by investing in attractively valued, profitable, defensive, and small companies.

Improved risk profile by holding a diversified portfolio that favors defensive and high-quality stocks.

Focus: Our strength lies in data-driven stock selection. Our long experience and attention to details allow us to offer exceptional investment models.

Infrastructure: With our efficient, modular, and scalable infrastructure, we are swift and flexible enough to respond to the changes in markets and customer needs.

Many of our strategies also provide access to very small stocks, a relatively inefficient market segment with capacity constraints often ignored by large providers.

Working on applying machine learning to stock selection problems for over a decade, we offer access to exceptional data-driven investment solutions beyond the current AI hype.

Quantitative researcher, UBS Asset Management

Head of Research, Finreon

PhD in St. Gallen (CH) on equity portfolio management

Studies: St. Gallen (CH), SMU (Singapore), USC (US)

Quantitative researcher, UBS Asset Management

Quant equity portfolio manager, Kraus Partner

PhD in St. Gallen (CH) on equity selection using AI

Studies: Columbia, Boston/BU, UCLA (all US), Mannheim (DE), St. Gallen (CH)

We analyze more than 8,000 stocks daily to keep up with new information flows.

Our server farm boasts hundreds of cores to process hundreds of millions of data points each day.

Our systems are fully automated to ensure that our decision-making is strictly rules-based and emotionless.

Our proprietary software stack currently includes more than a quarter of a million lines of code.